Personal Banking

Who Is Cornerstone Capital Bank?

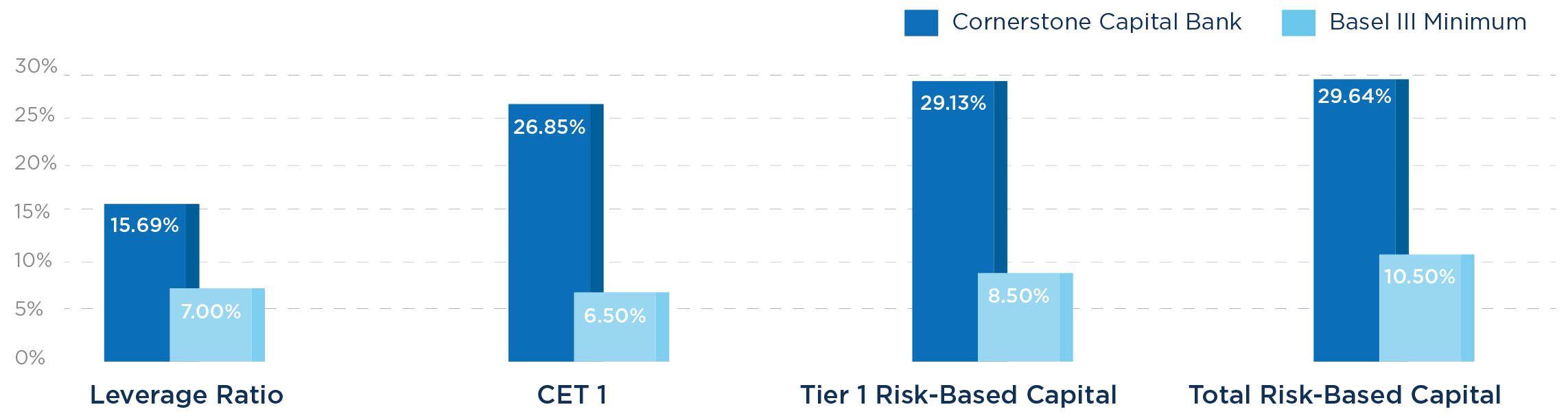

Cornerstone Capital Bank started as two separate companies–a local Texas bank and a national mortgage lender. The combined 150 years of dedication to learning what customers need when making financial decisions drove a master-minded acquisition of Roscoe Bank by Cornerstone Home Lending resulting in one of the highest capitalized de novo banks in U.S. history. We first lead the charge in making mortgage fast and digital, and now we are doing it with banking. Our clients get more banking and mortgage benefits, simpler mobile and online access plus the option of walking into a branch for one-on-one financial support. We aren’t the new kid on the block, we are the trusted, long-time neighbor.

News

Table Rock Mortgage Transforms Home Financing in Treasure Valley

Jul. 03, 2025Cornerstone’s Elite: Scotsman Guide Honors High-Producing Loan Officers

Apr. 21, 2025Cornerstone Capital Bank Wins 2024 Service Provider of the Year

Apr. 07, 2025Cornerstone Capital Bank Forms Joint Ventures with Texas, North Carolina Homebuilders

Mar. 25, 2025Cornerstone Capital Bank Launches Community Lending Division to Expand Homeownership Opportunities

Feb. 03, 2025Awards

2023

Houston Business Journal Family-Owned Business Award recognizing financial performance and community service (2023, large company category) | LINK

ICBA Top Lenders List Nationwide, banks > $1 billion in assets (2023) | LINK

Top Workplace - San Antonio Express-News (2023)

Top Workplace - Houston Chronicle (2023)