Personal Banking

Bank with Confidence

Financial institutions across the country depend on the strength of Cornerstone Capital Bank to meet loan growth and diversification objectives, generate meaningful returns on excess liquidity, and serve their customers’ home mortgage needs. Our institutional banking team delivers seamless experiences for the community banks, credit unions, trust companies, and investment firms they serve.

4th Quarter 2025 Financial Highlights

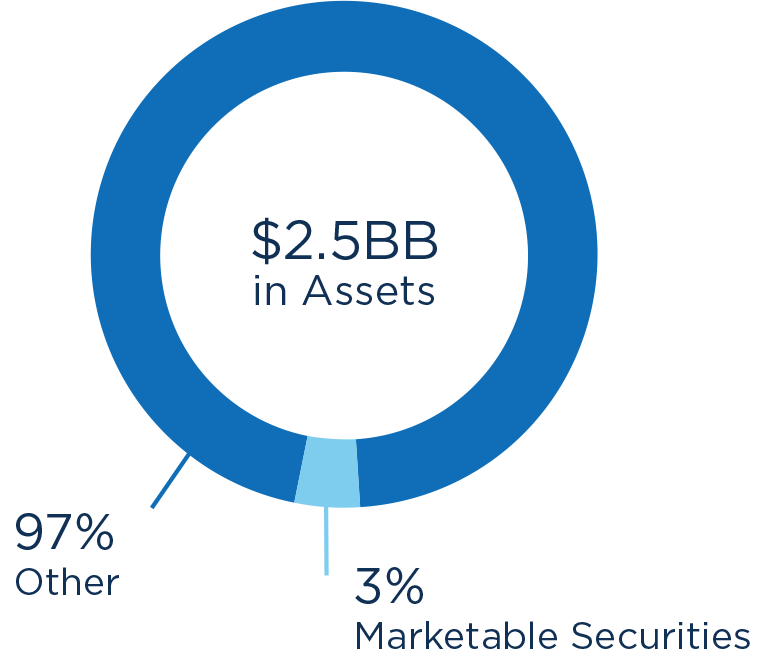

Assets

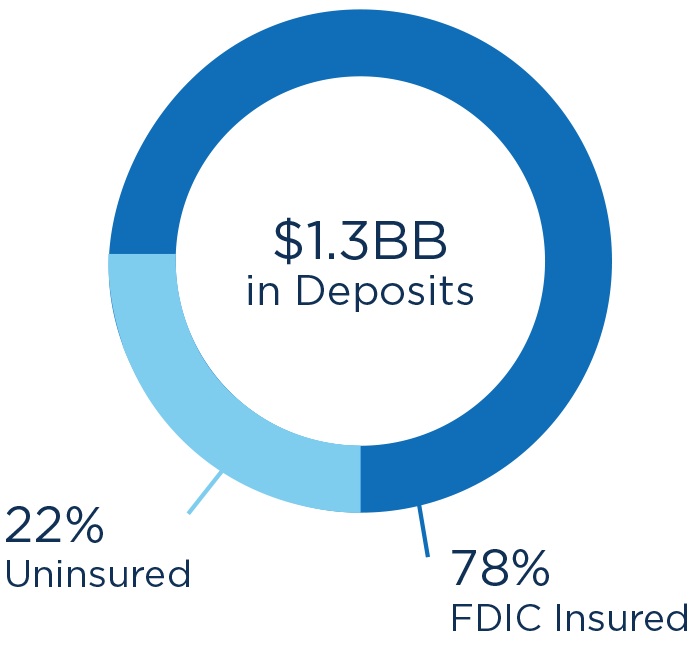

Deposits

Cash plus marketable securities is

1.6 times

the amount of uninsured deposits

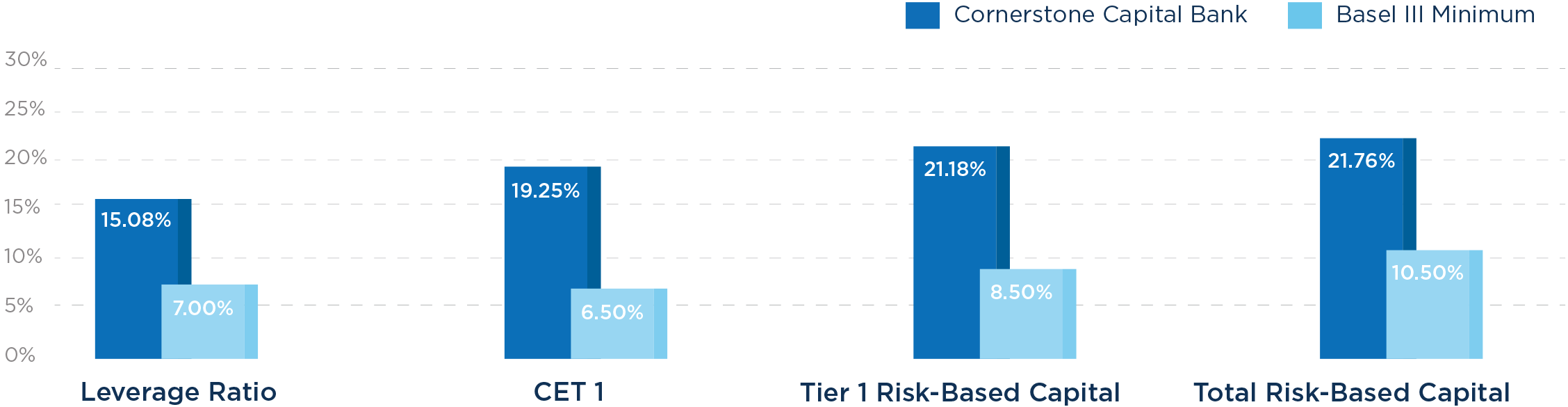

The bank’s capital well exceeds the highest regulatory thresholds.

YTD Highlights

Loan Growth

+0%

Deposit Growth

-5.2%

Top 50

Mortgage Companies in America

Recognized as an

ICBA

Top Lender

Top 1%

of All Companies on Glassdoor

#26

Top Places to Work by USA TODAY

Offerings

Our institutional experts serve community banks, credit unions, trust companies, and investment firms across the nation with asset and liability support. We bring efficiency and positivity into every interaction and we’re here to help your institution:

- Meet loan growth and diversification objectives with high-quality assets

- Generate meaningful returns on excess liquidity

- Include mortgage loans in your profile, on your terms

Performance Indicators

- Low Accumulated Other Comprehensive Income (AOCI) compared to the 100 U.S. banks of similar size

- A diversified and stable deposit base

- Strong sources of liquidity including multiple available and unfunded lines of credit

- Existing regulatory capital over $350MM

- Non-interest income as a % of assets in the top quartile of peer banks